April 4, 2023 • News and Promotions

Why Should I Send a Wire Transfer to India with MoneyGram?

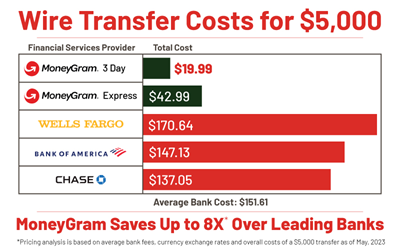

Sending a lot of money overseas can also cost you a lot of money if you're doing online wire transfers with your average bank.

But at MoneyGram, we have more than 80 years of experience transferring funds around the world, and we believe it should be affordable too.

That's why you can use MoneyGram to send more money to India with an average savings of 8X* over banks.

Plus, when you need to send even more money, we have a new wire transfer limit of $25K.

What's the difference between a money transfer and a wire transfer?

Well, put simply, a money transfer involves moving money from one person to another, while a wire transfer involves moving money from one bank account to another bank account. So, in a way, a wire transfer is a specific type of money transfer. And the good news is, at MoneyGram, we do both!

How do I know I can trust MoneyGram with my wire transfer to India?

Besides our decades of experience, we're also trusted by 40 million+ users annually to move their money around the world. They love us because we're:

What's the best way to send wire transfers to India with MoneyGram? Send Wire Transfers to India Online or with the MoneyGram® Money Transfers App for Apple Phones (iOS) or the MoneyGram® Money Transfers App for Android. To learn more about the MoneyGram® Money Transfers App visit MoneyGram.App.